does draftkings send tax forms

Its stated in the tax section on every app. Forms 1099-MISC and Forms W-2G will become available.

Draftkings Florida Is Draftkings Legal In Florida November Update

Please advise as to where I input.

. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. Mile_High_Man 3 yr. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it.

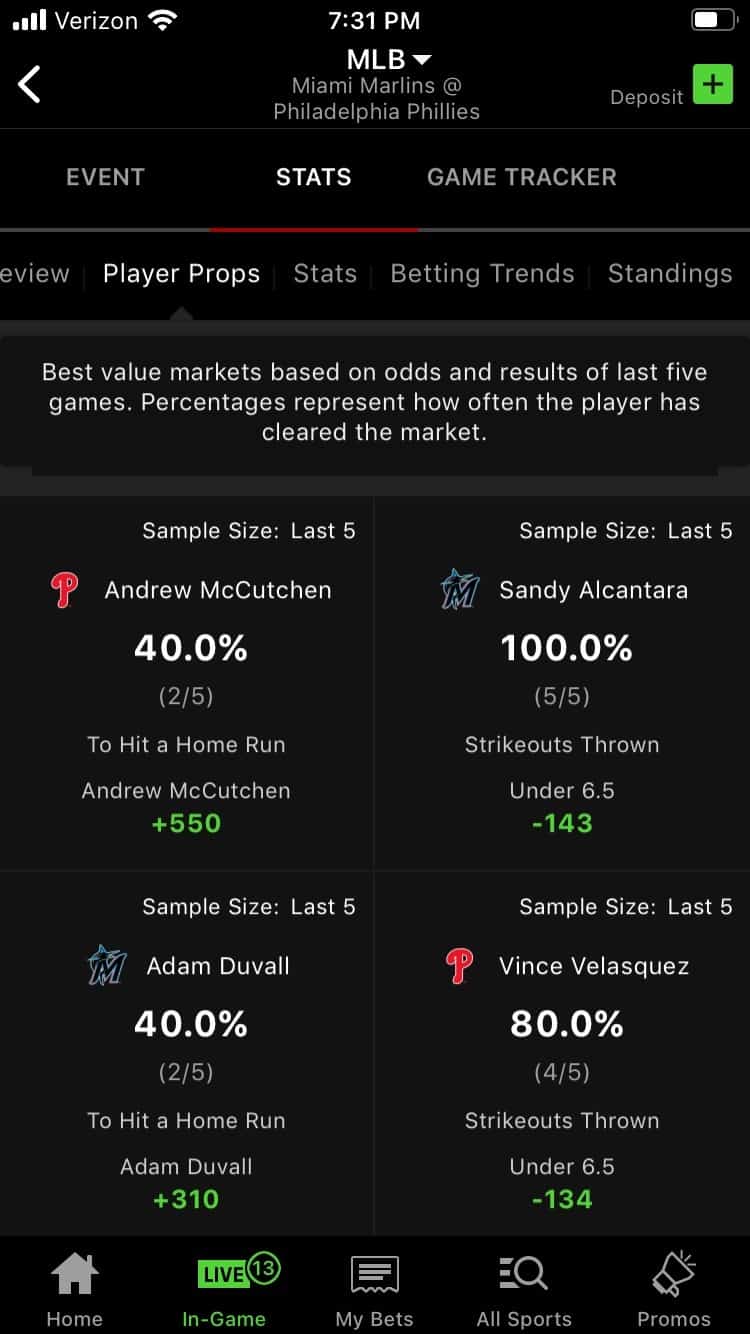

You Might Get a Form W-2G. Only when you have a wager meeting. If a player meets the reportable thresholds and.

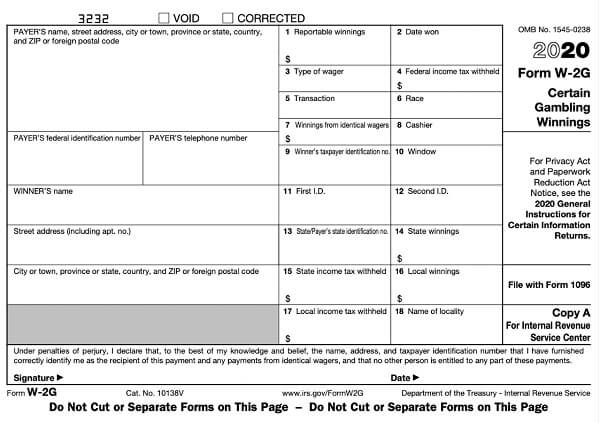

Generally youll receive an IRS Form W-2G opens in new tab if your gambling winnings are at least 600 and the payout is at least 300 times the. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the.

For legal sportsbooks a taxable event is considered a 600 net profit at 300 to 1 odds on a winning wager. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year. How do I update.

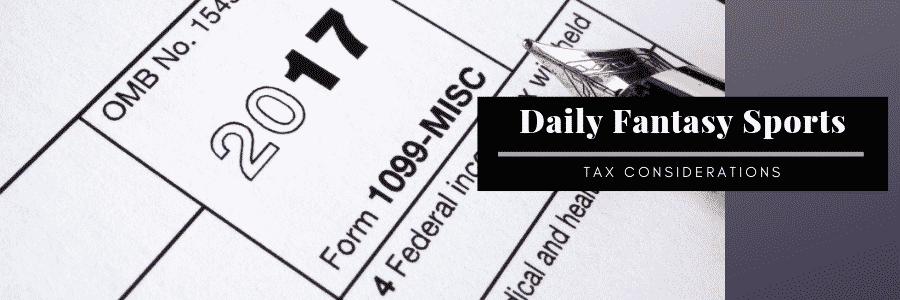

Fantasy sports winnings of at least 600 are reported to the IRS. We are required to send out a 1099 Tax Form to those who have earned 600 or more on the year. Why am I being asked to fill out an IRS Form W-9 for DraftKings.

On the Confirm Your W-9 Filing page below Name and mailing address tapclick the box next to. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both. Why am I being asked to fill out an IRS Form W-9 for DraftKings.

Fan Duel sent me mine via e-mail about a week ago. If you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS. The information provided by the player on the W-9 name social security number and address is used by DraftKings to populate IRS Forms W-2G andor 1099-Misc.

If you have greater than 600 of net earnings during a calendar year you can expect to receive an IRS Form 1099-Misc from DraftKings no later than February 28th. In most states daily fantasy winnings of any amount are considered taxable income. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

Navigate to the DraftKings Tax ID form. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites. If you have a.

If you did not receive a W-2G form the IRS says taxpayers are still required to report all gambling income. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. Learn more about the IRSs taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling.

This form will include all net. Key tax dates for DraftKings -. Does Draftkings Provide Tax Forms.

41nsk7bcouwizm draftkings tax form 1099 where to find it how to fill 41nsk7bcouwizm draftkings sportsbook nj promo code for 1 050. Our team will compile this information in January of each year and send to those with 600 in. 6 rows Key tax dates for DraftKings - 2021.

You can expect to receive your tax forms no.

Draftkings Sportsbook Review 1 000 Deposit Bonus Promo Code

Draftkings May Owe Taxes On Entry Fees Under A New Irs Guidance Boston Business Journal

Daily Fantasy Sports Irs Memo Potentially Earth Shattering For Draftkings Fanduel Boston Business Journal

Draftkings Tax Form 1099 Where To Find It How To Fill

Dfs Taxes Will You Be Taxed For Winning At Fantasy Sports

Draftkings Inc 2022 Definitive Proxy Statement Def 14a

Draftkings Tax Form 1099 Where To Find It How To Fill

Refund Delays Stimulus Check Errors Foreshadow Rough Tax Season Bnn Bloomberg

Has Anyone Received Their Draftkings 1099 Yet Thanks R Dfsports

Draftkings Fined 150k By Nj Regulators In Proxy Betting Settlement

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Draftkings Canada Download The Ontario Sportsbook App

How To File Your Taxes If You Bet On Sports Explained

Analysis What To Make Of Sec Irs Investigations Into Draftkings

How To Make Money In Fantasy Sports Through Networking By G Ryan Better Marketing

When Will Draftkings Maryland Launch It S Coming Soon Sign Up Marylandreporter Com

How To Pay Taxes On Sports Betting Winnings Bookies Com

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com